How PDF Fraud and Forged Documents Operate: Common Tactics and Red Flags

Digital documents that look legitimate can hide subtle manipulations designed to mislead recipients. Criminals and careless actors exploit the flexibility of PDF files and common office templates to create counterfeit invoices, receipts, and legal documents. Typical techniques include editing metadata to conceal changes, overlaying text and images to hide alterations, and embedding fonts or images that mask discrepancies. Fraudsters often reuse official logos, mimic formatting, and tweak numerical values in ways that are hard to detect at a glance.

Certain visual clues often betray a forged file. Mismatched fonts, uneven spacing, inconsistent alignment, or color differences between sections indicate manual composition or editing. Metadata anomalies—such as a creation timestamp that postdates an expected issuance date or author fields that don’t match the purported sender—are strong signs of tampering. Another red flag is layered content: objects copied from other documents can sit on separate layers or as flattened images, obscuring the original source.

Financial forgery tactics include manipulated invoice numbers, altered bank details, and appended payment instructions directing funds to fraudulent accounts. Receipts may show altered totals, duplicated transaction IDs, or fabricated tax details. Attackers sometimes inject invisible characters or use lookalike characters (e.g., replacing “0” with “O” or using Unicode homoglyphs) to create values that appear correct to humans but fail automated validation. Recognizing these patterns—such as unexpected file properties, inconsistencies in numerical sequences, or suspicious payment directives—gives organizations and individuals the upper hand when deciding whether to trust a document.

Practical Methods and Tools to Detect PDF Forgery

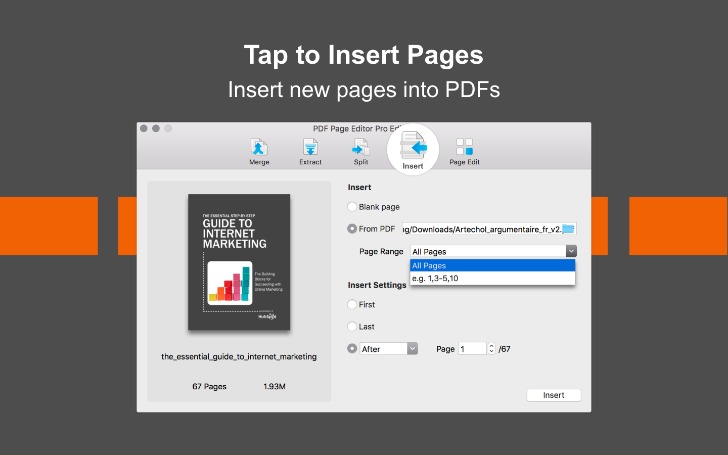

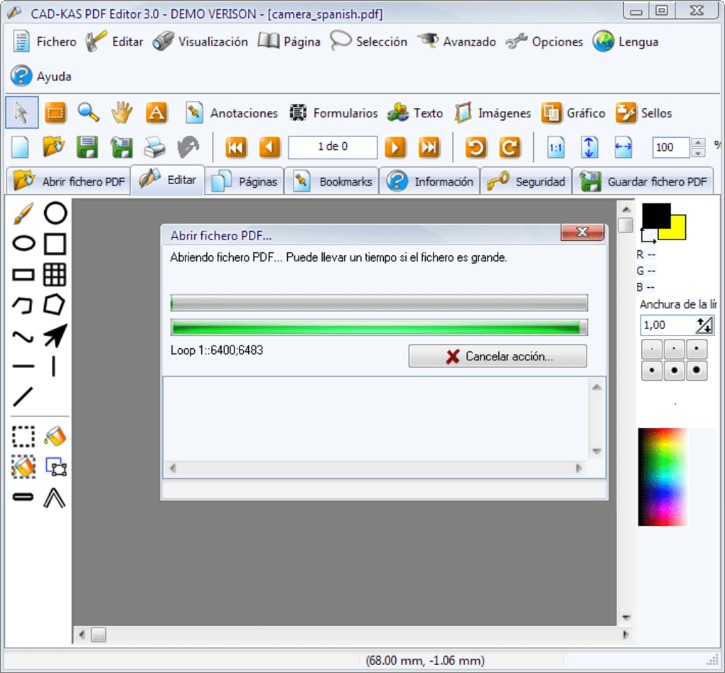

Detecting fraud in PDFs requires a mix of simple inspection techniques and dedicated tools. Start with basic verification steps: check the file’s metadata for creation and modification dates, examine document properties for embedded fonts or unusual software signatures, and review the document visually at high zoom to catch pasted images, cloned elements, or compression artifacts. Comparing the suspect document to a known authentic template often reveals subtle differences in layout, font metrics, or wording.

Advanced detection relies on specialized software that can parse layers, extract embedded objects, and analyze text integrity. Optical character recognition (OCR) can expose inconsistencies between image-based text and selectable text layers. Hash-based comparison and digital signature validation are essential when originals are available; an invalid or missing signature where one is expected should prompt further scrutiny. For recurring invoice or receipt processing, automated rules can flag anomalies in sequence numbers, vendor details, or tax calculations.

Online services and standalone applications can assist anyone who needs to detect fake pdf content quickly. These tools often combine metadata analysis, signature checks, and visual comparison to highlight suspicious elements. Integrating such checks into accounts-payable workflows prevents fraudulent payments by requiring multi-step approval, vendor verification, and cross-referencing of bank details. Training staff to spot telltale signs—such as last-minute email changes, pressure to pay quickly, or mismatched contact information—complements technical measures and reduces the chance of successful scams.

Real-World Examples, Case Studies and Best Practices for Preventing Invoice and Receipt Fraud

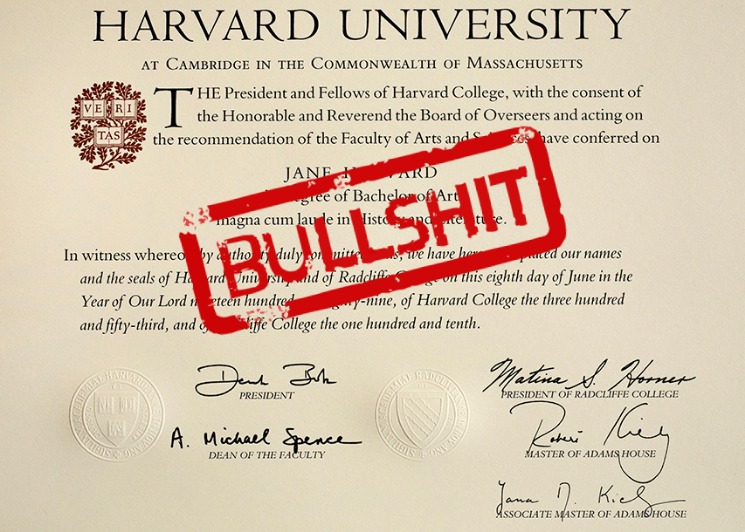

Several high-profile cases demonstrate how small oversights allow fraudulent PDFs to succeed. In one scenario, a company received a convincingly formatted invoice that redirected payment to a new bank account. The fraud succeeded because the accounts-payable team relied on visual inspection alone and did not verify the change through an independent communication channel. In another case, a vendor’s emailed receipt included an altered tax amount that slipped past automated checks because the system accepted image-based totals without OCR verification.

Best practices drawn from these incidents emphasize layered defenses. Implement multi-factor vendor verification: require authenticated vendor portals, confirm bank-account changes by phone using pre-existing contact details, and mandate email address whitelisting for invoice submissions. Employ digital signatures and public-key infrastructure (PKI) for critical documents so that recipients can validate origin and integrity. Periodic audits of processed invoices and receipts—cross-checking them against purchase orders, delivery confirmations, and contract terms—uncover irregularities before payments are finalized.

Education and process design matter as much as technology. Regular training sessions that present real-world fake invoice and fake receipt examples sharpen employees’ instincts. Set up escalation procedures for suspicious documents and use anomaly detection rules that flag outliers in vendor behavior, invoice frequency, or payment amounts. By combining vigilance with tools—such as signature checking, OCR-based validation, and metadata inspection—organizations substantially reduce exposure to detect fraud invoice and detect fraud receipt schemes while maintaining efficient operations.